The emerging market turmoil is over eh?

Well, one of Thailand’s state owned bank just experienced a bank run. Yes you read it right…state owned.

From the Wall Street Journal (bold mine)

Depositors have withdrawn nearly $1 billion from a bank linked to a foundering rice-subsidy program, the bank said Monday, in one of the first signs that Thailand's months-old political stalemate is starting to affect the economy.Adding to the pressure on Prime Minister Yingluck Shinawatra, a government agency Monday forecast economic growth rates would slow in the months to come because of the unrest. The prime minister has faced street protests since November calling on her to resign.Woravit Chailimpamontri, chief executive at Government Savings Bank, said that depositors withdrew 30 billion baht, or $930 million, over the past three days after the bank extended a 5 billion-baht loan to a financial cooperative involved in a state-subsidy program.The cooperative, which buys rice from farmers at up to 50% above market prices, has been singled out by the antigovernment protesters as representative of the kind of damaging populist policies pursued by the prime minister to build rural support, which has translated into large parliamentary majorities.As the withdrawals at Government Savings Bank worsened, Mr. Woravit said it wouldn't extend any further loans to the Bank for Agriculture and Agricultural Cooperatives, which manages the rice subsidy program.In recent weeks, the Yingluck administration has struggled to secure loans from commercial banks to pay the rice farmers, who are demanding payment for grain they already handed over to the government.

This is a prime of example of the realism of UK Prime Minister’s popular quote “The problem with socialism is that eventually you run out of other people's money”.

Thai’s government extended subsidies to farmers at the expense of the rest of the society in order to buy popular votes via state sponsored loans. However economic reality eventually exposed on the mirage of such free lunch policies.

Now the foolishness and resource draining activities by the government has been seen by the financial institutions. So they withhold from further extending loans to Thai’s Government Savings Bank. In short, other financial institutions have become aware of the risks of potential financial losses. So depositors stampede out from the bank, while other banks withhold provision of financing. The mass withdrawals in the face of unbacked or insufficient reserves now extrapolates to a classic bank run.

Naturally, the Thai central bank will step in to bail out the Government Savings Bank. But of course the question is how will the bailout be done? Loans in exchange for what? Another question: what will be the real effects of such bailout? Intensifying consumer price inflation?

And there is also the issue of which banks or financial institutions have significant exposure in the government bank. Will there be a contagion? Or will Thailand’s central bank, the Bank of Thailand, like China’s PBOC, do a “whack a mole” approach of bailing out any delinquent debt burdened entities that surface?

Remember, Thailand like any ASEAN has been a bubble economy, whom has largely depended on credit inflation that has bolstered asset prices to generate statistical growth.

Nevertheless it’s been a don’t worry be happy for Thai’s financial markets.

Yields of Thai’s 10 year sovereign has declined (bond rallied) even in the face of the 3 day mass bank withdrawal.

The Thai baht which has been bludgeoned since Abenomics-Taper seems to be having an oversold bounce.

And Thai stocks as benchmarked by the SET has been having a field day. Like the Philippines, they are in a denial rally mode.

But some segments of the credit markets haven’t shared the same enthusiasm as with the stock market punters and treasury bulls.

Default risks as measured by the 5 year CDS has topped the 2013 Abenomics-Taper highs. Will this bank run up the ante?

Now some harsh reality for the mainstream throng afflicted by the Aldous Huxley syndrome who keeps chanting “forex reserves”, “forex reserves”, “forex reserves”!

Realize that Thai forex reserves from a high of US $189 billion has now declined to US 167 billion (top) (most likely used to defend against tanking baht) whereas government external debt keeps advancing (bottom). External debt has reached $139 billion and continues to grow. Thus in the context of proportionality, external debt now comprises 83% of Thai’s forex reserves. That’s a very slim cushion.

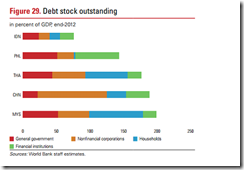

But but but…now if we reckon Thai’s overall debt levels which has been at nearly 200% of GDP according to estimates from the World Bank, with Thai’s GDP at US$ 366 billion in 2012, this means that Thai’s debt should be way above $500 billion. This means that any contagion from a credit event would render forex reserves a puny shield which seems a "laughable" alibi based on attribute substitution fallacy--because the forex defense smoke screen is a 'fugasi'.

If you fail to notice, we seem to seeing INCREASING account of debt problems surfacing in Asia. These are signs that current conditions are hardly hunky dory. And equally these are signs that the current episode of debt problems have been most likely the icing on the cake. This serves as more evidence of the periphery to core dynamic of a typical credit bubble cycle. As Doug Noland of the Credit Bubble Bulletin nicely puts it “EM is the global “subprime.”

There is no such thing as free lunch. Excessive debt will have its day of reckoning, which seems sooner rather than later.

Of course, the worst part is that when (and not if) these imbalances come unglued, the reaction should be swift and dramatic. That’s why I see the 2014-2015 window as very fertile environment for a global black swan event.

Caveat emptor.

1 comment:

Meet the new economic dynamic: destructionism; it is emerging, as investors are derisking out of debt trades, and out of currency carry trades once again just yesterday on Wednesday February 19, 2013.

Destructionism is replacing inflationism as the world’s economic dynamic; this comes from the bond vigilantes calling the Benchmark Interest Rate, ^TNX, higher from 2.48%, beginning on October 23, 2013, and investors derisking out of World Stocks, VT, and Nation Investment, EFA, as well as Global Financials, IXG, on January 22, 2014, on fears that the world central banks’ monetary policies have turned money good investment bad.

Destructionism is forcing the Small Cap Pure Value Stocks, RZV, to fall faster than the Small Cap Pure Growth Stocks, RZB, and destructionism is forcing the Large Cap Value Stocks, JKF, to fall faster than the Large Cap Growth Stocks, JKE, as is seen in their combined ongoing Yahoo Finance chart, suggesting that value cannot be found in investing.

The bond vigilantes in calling the Benchmark Interest Rate, $TNX, higher from 2.48%, and the currency traders following in selling the Major World Currencies, DBV, and Emerging Market Currencies, CEW, have created two extinction events, the first the death of fiat money on October 23, 2013, and the second the death of fiat wealth on January 22, 2014; these twin extinction events terminated the age and paradigm of liberalism and have introduced the age of authoritarianism.

Meet the new person: the debt serf; he is emerging via diktat money.

Just as the woolly mammoth was made extinct by a sudden ice age extinction event, liberalism’s investor is being made extinct, as the dynamos of liberalism, these being creditism, corporatism, and globalism, are winding down.

Furthermore the investor’s habitat, this being democratic nation states and banks, are being literally obliterated as you write here in this article.

The nature of personhood is changing, given the extinction of liberalism's investor and his investment choice, and the death of fiat money and fiat wealth, ... the new person is emerging, ... that being the debt serf, and his economic activity, that being debt servitude, through the creation of diktat money.

Inasmuch as democratic nation states are crumbling, new regional sovereign authority is rising establishing the debt serf’s habitat, that is a regional gulag of regional economic governance and totalitarian collectivism; the Eurozone is ground zero for this new habitat, with European Voice reporting Eurogroup sends Troika back to Greece. No decision on further financing for Greece until the summer, says Eurogroup chief.

An inquiring mind asks, who is one going to be?

No one wants to be a debt serf; but liberalism’s singular dynamo of regionalism, operating within economic fascism, is producing authoritarianism’s person.

There are two options, one can have fiat identity and experience within libertarianism.

Or one can have elect identity and experience, as is presented by the Apostle Paul in Ephesians 1:4, within dispensationism, or perhaps better said, within dispensation, that is the economy of God as is presented by in Ephesians 1:10.

Post a Comment